Countries with peace and security thrive in terms of economic development and human rights advancements, while those that suffer from weak governance cannot seem to break the cycle of chronic conflicts and turmoil. This clear correlation between sustainable development and societal stability has long been recognized by scholars and sustainability professionals. The United Nations Sustainable Development Goals (SDGs), which came in effect in September 2015, replacing the Millennium Development Goals (MDGs) in 2016, have taken the ambitious stance to address this issue through SDG 16: “Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels.” SDG 16 is also considered to be a crucial means to other sustainable development achievements.

There are three dimensions to SDG 16, Strong Institutions, Justice and Peace. Each of these dimensions reinforces one another:

- The Strong Institution dimension sets out to establish effective, accountable and transparent institutions, which secure fundamental legal human rights.

- The Justice dimension tackles issues of corruption and bribery that would threaten such institutions, and ensures equal access to justice.

- The Peace dimension aims to eliminate all forms of violence against vulnerable groups and promote resolution of any arising conflicts through dialog, negotiation and diplomacy.

At first glance, the role of the private sector in delivering SDG 16 might seem imperceptible. In practice, however, companies can create profound contributions to SDG 16 through their sustainable procurement programs. One of the industries we see most likely to positively contribute to the achievement of SDG 16 is the Financial Services sector. Here’s why:

Unveiling Supply Chain Risks

The Financial Services sector is not one many would immediately imagine having significant environmental or social risks within its supply chain. Yet, with its global presence now firmly established, its supply chain impact is considerable. According to the report Supply Chain Sustainability in the Financial Sector by Business for Social Responsibility (BSR), information technology, employment and professional services are the top spend categories for the Financial Services sector. These spend categories can be translated into two main supply chain risks related to SDG 16: conflict and human rights issues and institution issues.

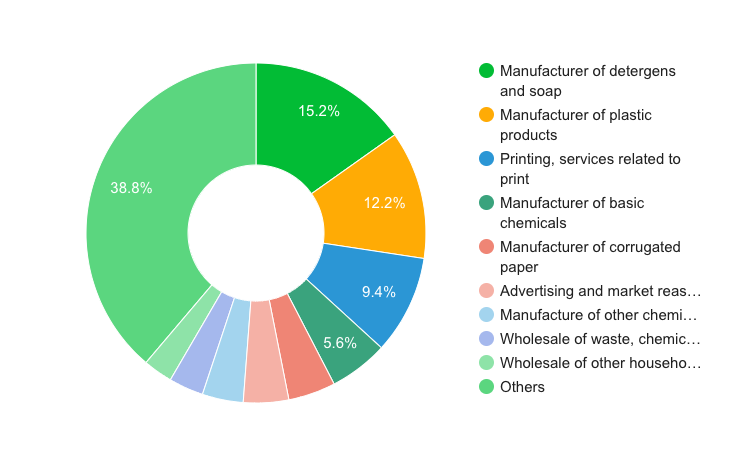

Example profile of the business activity of suppliers assessed by EcoVadis in the Financial Services sector

Conflict and Human Rights Issues

We can recall that the biggest spend category of Financial Services sector is information technology, which largely involves the purchase of IT equipment. While price and performance efficiency would be the main consideration when making such purchases, the origins of the electronic components that go into this type of equipment should be thoroughly examined as well. This leads to the issue of conflict minerals. As defined by the U.S. legislation, conflict minerals often refer to tin, tantalum, tungsten and gold (3TG). The name came from the fact that profit from these minerals have long been used to fund armed groups and fuel regional conflicts, specifically in eastern part of Democratic Republic of Congo (DRC). These armed groups have caused millions of deaths over the years; they are also present in over 50 percent of the mining sites in the area, where human rights issues such as child labor, forced labor, violence and rapes, among others, are prevalent.

To achieve a supply chain free of human rights violations, Financial Services companies can proactively communicate anti-child and forced labor commitments to their suppliers, require their suppliers to have child and forced labor prevention mechanisms and also urge suppliers potentially sourcing minerals or metals from conflicted areas to conduct due diligence checks and favor those who have reported on the results.

Institution Issues

According to the United Nations Development Programme (UNDP), corruption, bribery, theft and tax evasion cost developing countries US$1.26 trillion annually. In addition to the economic deficit, corruption is also detrimental to institutional robustness, which is necessary to maintain societal stability. When institutional support is eroded, organized crime, market inefficiency and human rights violations spread. Corruption can take the form of bribery, fraud, insider trading or even value manipulation in transactions and loan collateral. Financial Service companies need to build transparency along the supply chain by conducting risk and impact assessments to identify the weak links that may contribute to corruption and impair the rule of law.

Taking Action

All in all, delivering SDG 16 through sustainable procurement in the Financial Service sector is not only relevant, but turns out to be crucial as well. So where can we start?

Prioritizing Spend Categories and Suppliers

To utilize resources in the most efficient way and aim for optimal improvement on their own impacts, companies should recognize which spend categories and/or suppliers pose the greatest and/or urgent risks in their supply chain toward the achievement of SDG 16, and should focus on those first. Financial Service companies can take advantage of a preliminary risk assessments of their supply chain and assign risk ratings to each of the spend categories to prioritize necessary efforts.

See how Finance and Insurance giant Axa are developing their program for supplier monitoring.

Integrating into Procurement and Supplier Selection Processes

Implementing sustainability criteria into procurement and supplier selection processes is a grounding and essential step towards supply chain transformation. Financial Services companies that aspire to have their supply chain free of conflict, corruption and human rights violations should embed these principles into service contract clauses and requests for proposals (RFPs). For instance, BNP Paribas has demanded its suppliers to commit to a CSR charter since 2012 and in 2014, has integrated criteria regarding child labor into their call for tenders for promotional items. Moreover, the results of CSR assessment of suppliers have been given considerable weights in the supplier selection final decision. An additional step forward could take the form of integrating suppliers’ social responsibility performance into the company buyers’ appraisal. This would create more incentives for buyers to look beyond the traditional time and money factors when considering a supplier and help suppliers advance on their corporate social responsibility performances.

Looking Beyond Tier One Suppliers

To establish supply chain transparency, Financial Services companies have to be willing to go to great lengths to map their supply chains beyond first-tier suppliers. Putting sustainable procurement programs into practice throughout the supply chain with second and third-tier suppliers can foster accountability in key players involved in the process and create truly impactful momentum to eliminate human rights violations, conflicts and corruption.

Total System Services (TSYS), with its commitment to ethical sourcing of components and materials that might contain conflict minerals originated in the DRC, has conducted reasonable country of origin inquiry (RCOI) supply chain due diligence since 2016. The ROCI process aims to determine critical information such as presence and origin of the conflict minerals contained in the products from its suppliers, and in turn achieve transparency into the product supply chain and engage further with suppliers on conflict mineral issues.

Know Your Customer: Responsible Finance Expands To Business Lending and Beyond

Besides investing effort in sustainable procurement, positive impact can be made through what Financial Services companies deal with on a daily basis: provision of financial services/products. It is crucial that Financial Service companies understand the potential negative impact their services/products t can have, and that a great part of the responsibility to minimize that impact rest on their shoulders.

Financial Service companies can conduct due diligence on potential customers to guarantee that the money flow is not used to undermine fundamental human rights or institutional robustness, and on investment projects to determine the scale of human rights impacts. A report released by Singapore-based Asian Venture Philanthropy Network (AVPN) found that less than 1 percent of funds in Asia leverage ESG investing, which incorporates environmental, social and governance factors into companies’ decision-making. According to research from MSCI, companies in the bottom ESG quintile have been twice as likely to suffer a catastrophic loss (over 95 percent cumulative loss) within three years.

The ING Sustainability Improvement Loan, launched in May 2018, aims to reward sustainability performance through the use of sustainability ratings. This exciting new use of sustainability ratings helps business customers who engage in measuring and improving their sustainability to also benefit from better loan rates.

Achieving SDG 16 Through a Ripple Effect

The private sector, particularly the Financial Services sector, has a critical role to play in the achievement of SDG16. Sustainable procurement is definitely one of, if not the most powerful catalyst to push forward the necessary progress. A well-rounded and effective sustainable procurement program is an indispensable tool that would steer the companies in the right direction. By deliberately integrating the achievement of SDG 16 as a priority of their sustainable procurement program, companies in the Financial Services sector can set the example and influence other sectors to follow suit, thereby creating a contagious effect to both private and public sectors towards the realization of this challenging Sustainable Development Goal.

Resources and Strategies

With some 80 percent of global trade passing through supply chains, the UN Global Compact recognizes that targeting supply chains is one of the most effective ways for businesses to create a positive impact in the world and urges businesses to take a holistic approach to supply chain sustainability. As highlighted in a recent report, Decent Work in Global Supply Chains, companies — not just from the Finance Sector, but across all industries — which commit to taking action can significantly improve the lives of people even in the most deprived parts of the world.

The UN Global Compact continues to work with organizations across the world to provide peaceful and sustainable communities. Although the task is not easy and progress is gradual, advancement has been made in regulations to promote public access to information and strengthen institutions that uphold human rights at the national level. Over the past 20 years 116 out of 197 countries have established a national human rights institution, which have been peer-reviewed for compliance with international standards and freedom of information laws have been adopted by the same number of countries, with some 25 of them doing so in the past five years. More details on progress with regard to SDG16 — as well as other goals — is available in The Sustainable Development Goals Report 2018 and SDG Knowledge Platform.

If you have questions or comments on selecting supplier sustainability monitoring tools, contact us here for a consultation.

by Valerie Wang

This article was originally published on SustainableBrands.com

About the Author

Follow on Twitter Follow on Linkedin Visit Website More Content by EcoVadis EN