Nearly 100 professionals in procurement, supply chain and sustainability gathered together for EcoVadis’ first North American Sustainable Procurement and Finance Roundtable Series to learn more about how to proactively and efficiently leverage sustainable procurement best practices and discover untapped value opportunities throughout the supply chain.

EcoVadis hosted events in three major cities: San Francisco on September 11 at the historic Bently Reserve, New York on October 2 at the world-renowned UN Global Compact, and Chicago on October 3 at the global investment firm Northern Trust.

San Francisco

Industry expert Alexis Bateman, Director of Sustainable Supply Chains at the Massachusetts Institute of Technology, spoke with a high level of insight on the challenges of procurement and supplier management, paying special attention to topics such as capturing and measuring stakeholder priorities, vendor prioritization and effectively communicating and engaging suppliers on key expectations and requirements. Ms. Bateman also emphasized the differences between visibility, transparency, and traceability and urged procurement executives to prioritize each concept accordingly.

Bill Cooper, Associate Vice President and Chief Procurement Officer at the University of California (UC), spoke about his experiences leading a cross-departmental effort to improve supply chain efficiency and sustainability across 10 UC facilities. He emphasized the need to strategically align people and resources before initiating a new process or technology. Through the establishment of sustainable procurement working groups, the UC Small & Diverse Business Advisory Council, and a complete “sustainable procurement policy overhaul,” UC launched its “UC Supplier Sustainability Scorecard project,” achieved “early integration of sustainability with strategic sourcing,” and positioned sustainability as an “integral component of UC’s Supply Chain 500 initiative.” Of the numerous gems of wisdom, one key point resonated with every attendee – executive leadership buy-in is non-negotiable.

New York

Thought-provoking conversations continued at the United Nations Global Compact headquarters in New York City where participants identified strategies for integrating sustainable procurement into corporate culture, as well as establishing collaborative standards across industries and sectors to move the sustainability baseline forward.

Mega-trends cited by Andrew Winston, author of Green to Gold and The Big Pivot, resonated with the audience as good positioning for corporate leaders to act now. A recurring theme around the responsibility and necessity for businesses to step up was soon followed by John Tran, Director, Sustainability & Responsibility at Pernod Ricard who made the point that embedding sustainability into the core values and purpose of an organization can effectively yield stronger program engagement. Cindy Bush, Director, Environmental Health Safety & Sustainability at Tessy Plastics Corporation, concluded the speaking segment with an inspiring, true story of how one company’s greatest fear (losing its largest client) turned into its greatest opportunity. As Cindy noted, “it was all because someone asked” that Tessy Plastics set tremendous ESG goals and, through their “world class” TP3 (people, planet, product) initiative, have been able to “differentiate Tessy as a supplier to major brands” as well as “drive sustainability into Tessy’s supply chain.”

The afternoon transitioned into a roundtable on sustainable finance, where Tensie Whelan, Director, Professor for Business and Society at NYU Stern Center for Sustainable Business, discussed the financial benefits and competitive advantages of strong sustainability performance and ESG investing, as well as the associated challenges (particularly with measuring ROI). “When a company embeds sustainability in its strategy and practice it improves customer loyalty, employee relations, innovation, risk management, operational efficiency, supplier risks…, drives greater profitability, higher corporate valuation, lower cost of capital…, and delivers short- and long-term value creation for shareholders and society.” What followed was a practical illustration by Anne van Riel, head of Sustainable Finance Americas at ING on how these same sustainability drivers led ING toward some “unique opportunities.” She proceeded to describe how “ING constructed the first deal in the syndicated loan market where pricing is linked to a sustainability rating” through their sustainability improvement loans.

Chicago

The roundtable series wrapped up in Chicago, where thought leader Mark Finn, Professor of Accounting and International Business at the Kellogg School of Management, Northwestern University, opened the event with an overview of ESG reporting trends. Audience members were intrigued to hear that socially responsible investments (SRI) currently “represent 22% of total assets under management ($40.3 trillion); up from 18 percent in 2014.”

A prominent theme of the day, and present throughout the Luminaries series, was the need for incorporating ESG into the business model in order to realize long-term value creation. John Edelman, Managing Director, Global Engagement & Corporate Responsibility at Edelman, made the point that establishing systems and processes for accountability and transparency were key challenges for his organization. But through targeted efforts, and a shift in corporate culture, a sustainable procurement policy was executed by rating Edelman’s “largest spend categories.”

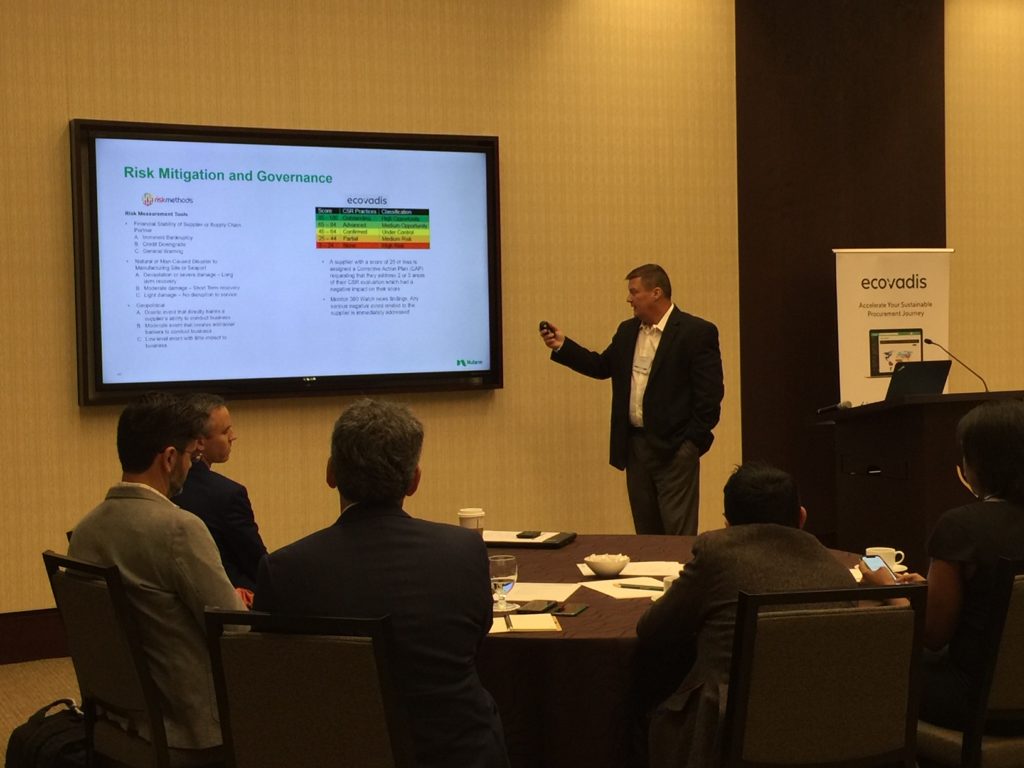

Clyde Rittel, Global Systems Process & Compliance Manager at Nufarm, also contributed to this theme by sharing Nufarm’s development of a “complete risk management policy” and how it helped his organization clearly “define and categorize their suppliers” according to their potential impacts. Mr. Rittel noted that the “risk matrix” was an essential first step toward greater visibility of supplier activities as well as the establishment of CSR governance. With this policy and the help of EcoVadis’ 360 Watch, NuFarm can monitor and assign “corrective action plans (CAP)” to suppliers under certain risk classifications and “request that they address 2 or 3 areas of their CSR evaluation which had a negative impact on their score.”

Business as usual is at the edge of a precipice, and now more than ever corporations – and their respective decision makers – are essential to solving the greatest environmental and social challenges of our time. And it’s for this reason EcoVadis felt especially privileged to host and be amongst three dynamic groups of North American business leaders, entrepreneurs, and thought experts eager to implement change.

As organizations embrace stronger commitments around sustainable development, particularly in procurement practices and supply chain operations, they must be adequately equipped with the necessary tools and strategies for success.

To find out more about how successful organizations around the world are in tackling sustainability challenges have a look at the Global CSR Risk and Performance Index 2018.

And if you’re interested in a quick assessment of your sustainable procurement practices take our free diagnostic, which comes with zero strings attached and gives you the answers in less than 10 minutes.