Last year, new sustainability reporting requirements in jurisdictions including California and the European Union captured business leaders’ attention. Now their focus is shifting to the Asia-Pacific region, where regulators are launching a number of new initiatives.

New Regulations, New Focus: Preparing for Mandatory Sustainability Disclosure

With these new rules on the horizon, now is the time for listed companies to start setting up the internal reporting and governance structures they’ll need when disclosure becomes mandatory.

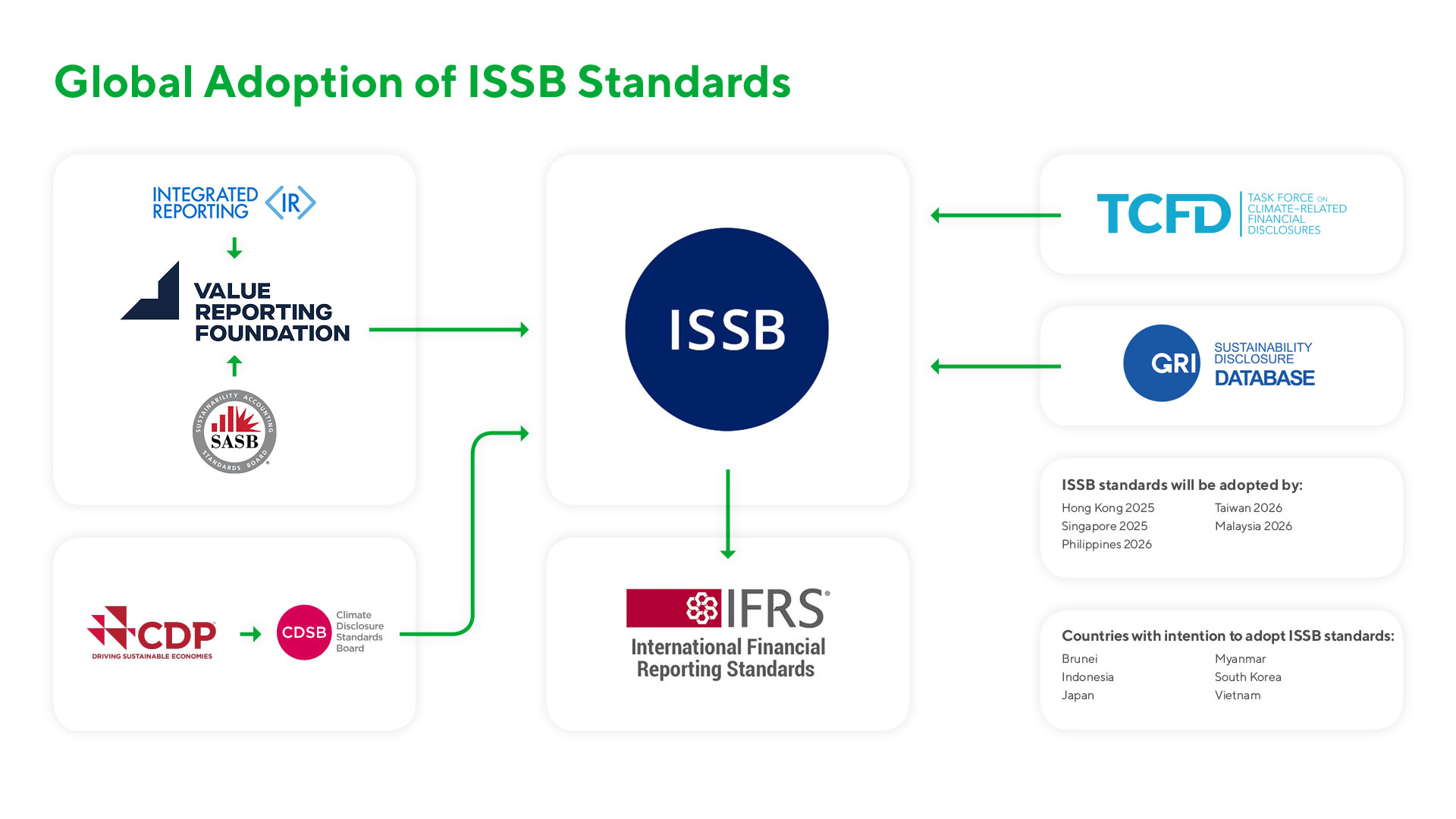

In general, APAC countries are aligning their climate-related disclosure standards with the IFRS Sustainability Disclosure Standards, developed by the International Sustainability Standards Board (ISSB) – welcome news for managers who have experience complying with these rules in other jurisdictions.

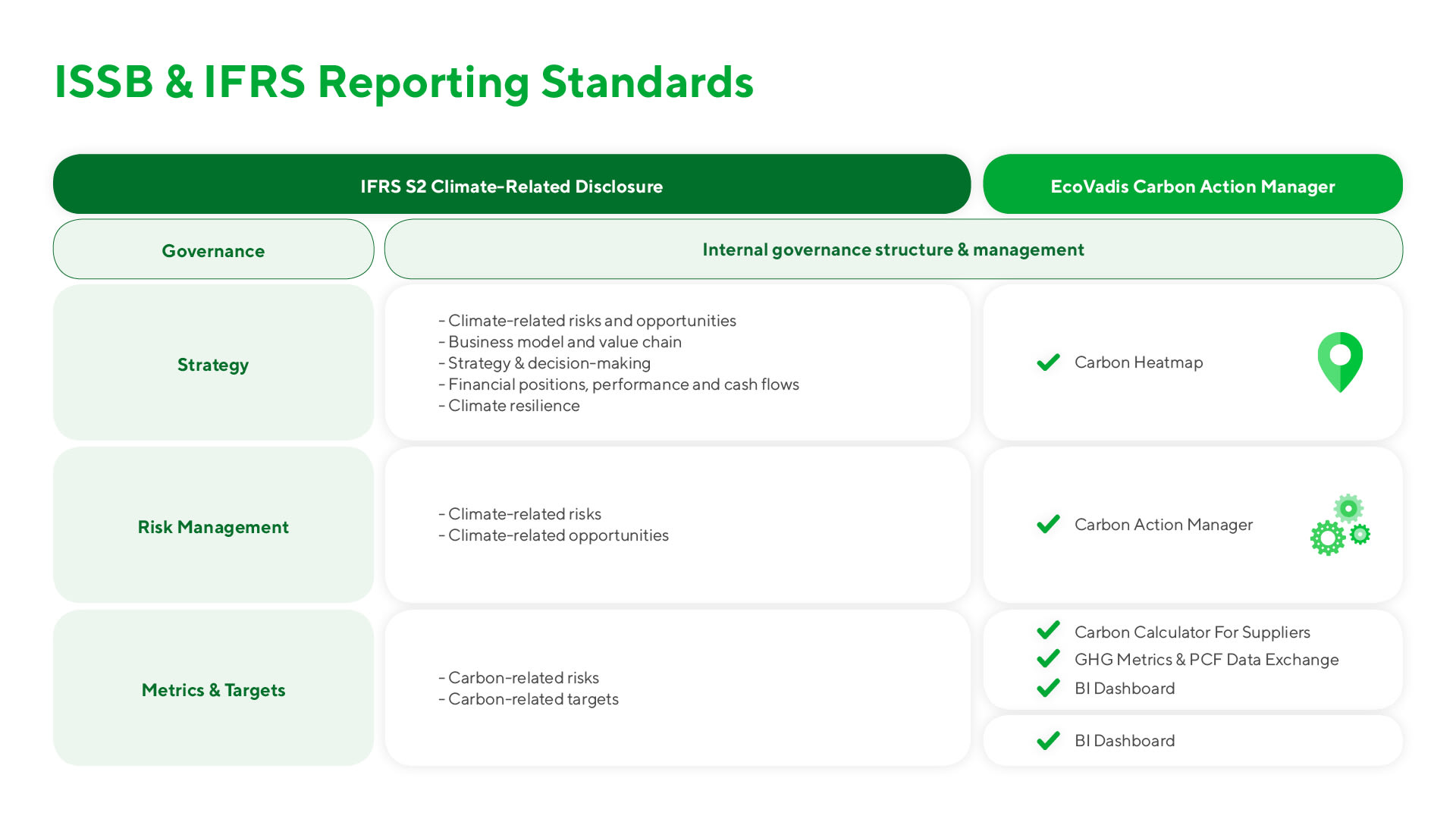

IFRS S2 consists of four pillars. Three are qualitative (governance, strategy, risk management); the fourth is quantitative (metrics & targets). That means it’s not enough to just collect data; companies need to be able to describe how they’re identifying, prioritizing and mitigating climate-related risks. EcoVadis’ Carbon Action Manager includes tools to manage the strategy, risk management, and metrics & targets pillars.

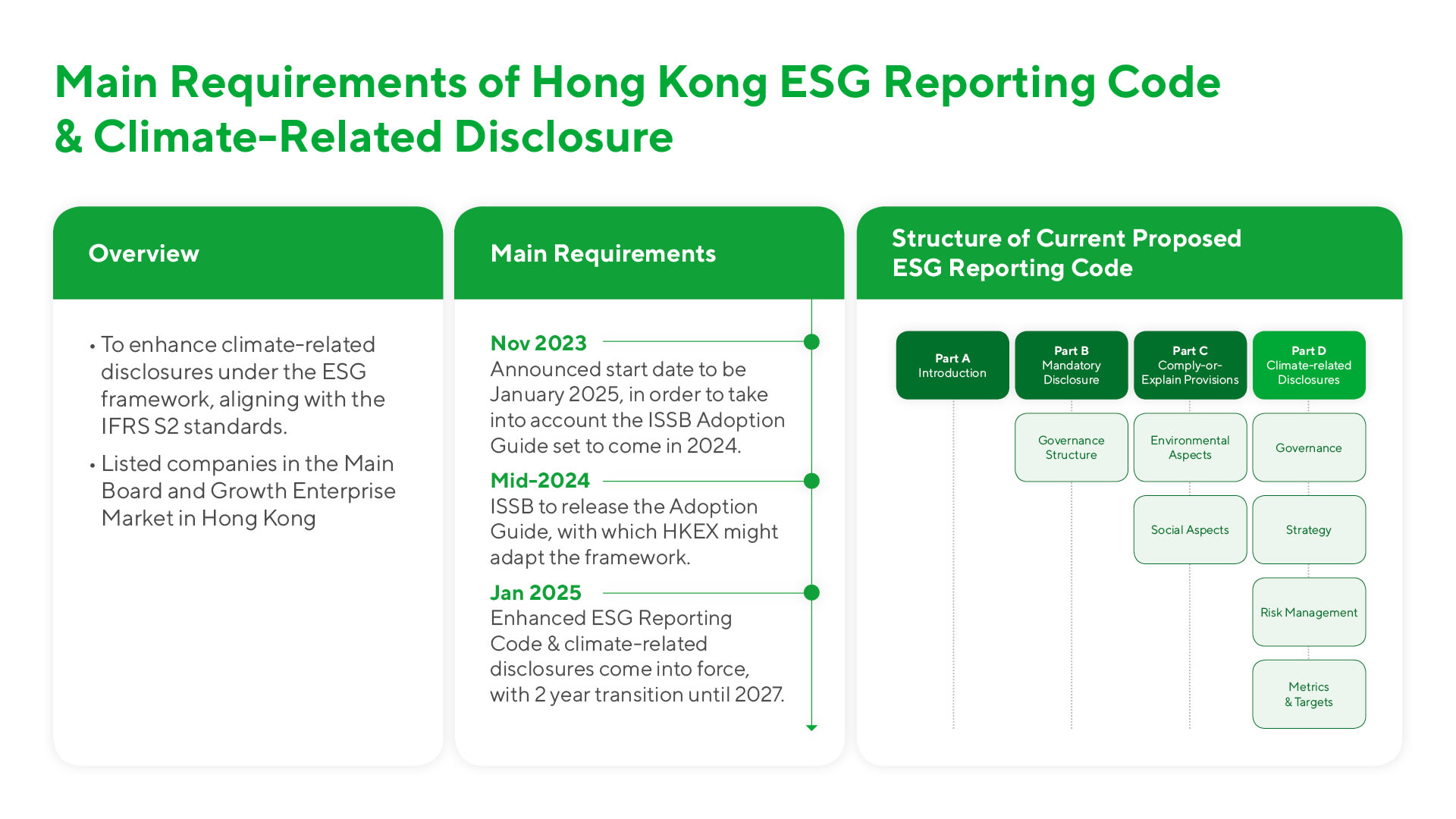

Hong Kong: Anticipated Updates to the ESG Reporting Guide

One APAC jurisdiction that’s keeping busy is Hong Kong, with issuers on the city’s stock exchange waiting on the much anticipated revision of the HK ESG Reporting Guide, due to take effect at the start of 2025. The new guidelines are built around the four IFRS pillars: Strategy, Governance, Risk Management and Metrics & Targets. Hong Kong-listed companies will be required to disclose Scope 1, Scope 2 and Scope 3 emissions data, as well as the financial impacts of climate-related risks and opportunities. However, the exchange has said certain requirements, such as Scope 3 emissions, may require more time to implement fully. The illustration below provides a summary of the rules.

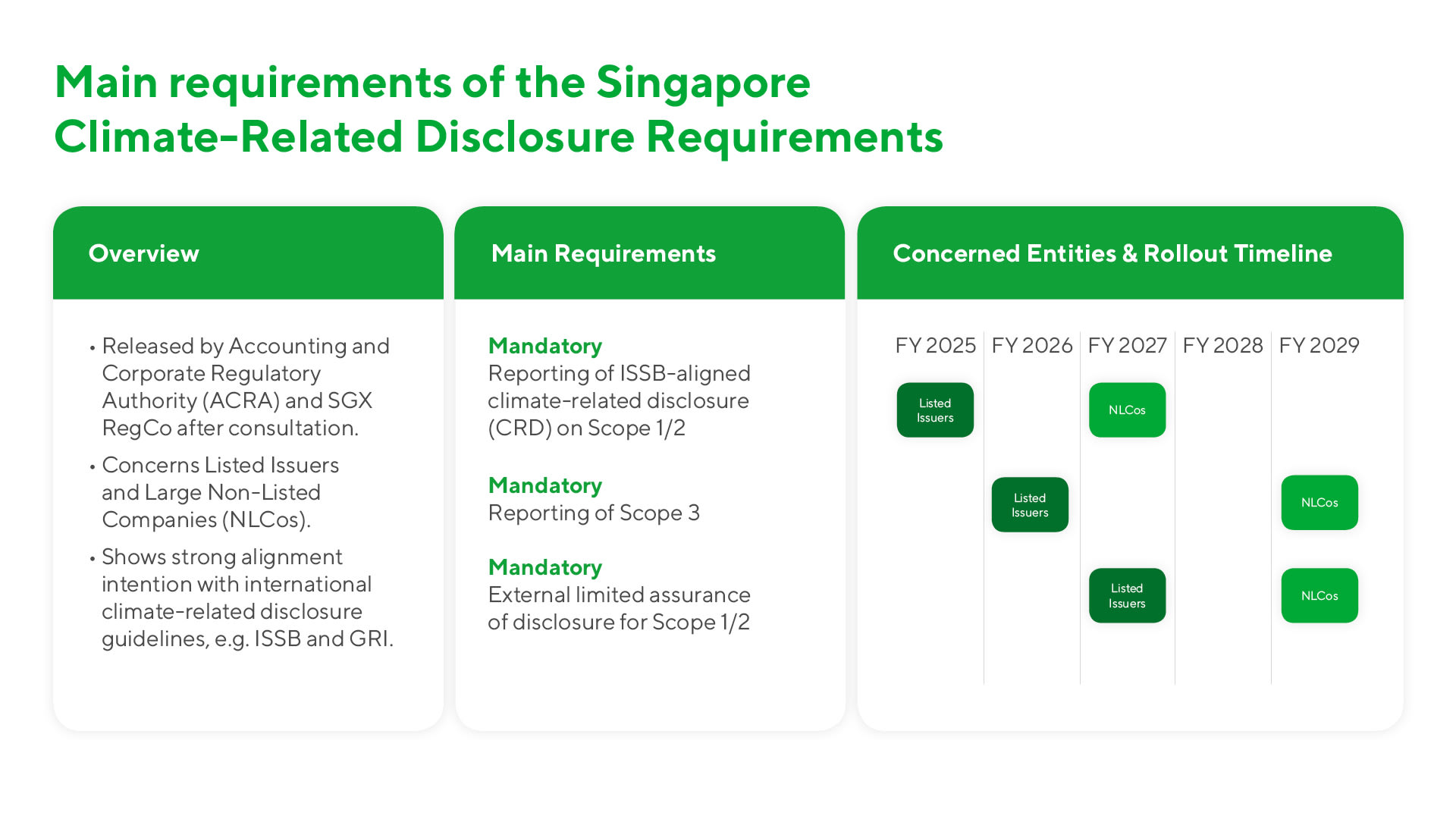

Singapore: A Leader in Sustainability Reporting

Singapore, meanwhile, is ahead of the game, in a way, and requires all listed companies to report on Scope 1 & 2 emissions beginning in their 2025 fiscal years. Scope 3 reporting will become mandatory starting in 2026, and the following year companies will need to obtain external limited assurance. The rules are part of a long-term trend in the city-state, following the imposition in 2016 of mandatory sustainability disclosure for certain entities that used a “Comply or Explain” model. Singapore’s regulations are strongly aligned with the ISSB and Global Reporting Initiative rules; for more information, see the illustration below.

Japan: Adapting ISSB Standards to Local Contexts

Elsewhere in the Asia-Pacific region, the Sustainability Standards Board of Japan (SSBJ) has been adapting the ISSB Standards for local use. While the country already requires ESG reporting for certain listed companies, the new rules will hone in on more specific climate-related metrics such as Scope 3 emissions metrics, which are not only tied to financial criteria. In March 2024, the SSBJ released a draft and called for feedback. Japanese companies may see voluntary reporting as soon as March 2025, and mandatory disclosures for listed companies by March 2028.

The Japanese rules are part of a broader trend of ESG metrics consolidating around IFRS Sustainability Disclosure Standards S1 and S2, described in the following chart, which are comprehensive and growing in popularity.

IFRS S1 sets a reporting standard for general sustainability-related financial information, while IFRS S2 governs disclosure of more specific climate-related metrics. Simply collecting data may not suffice for S2; companies must be able to show that they’re identifying, prioritizing and mitigating climate-related risks.

How EcoVadis’ Carbon Action Manager Supports IFRS S2 Climate-Related Disclosure

Companies can use the EcoVadis Carbon Action Manager to collect Scope 1, 2 and 3 carbon data from suppliers and calculate their Scope 3 emissions. The interactive platform establishes communication with suppliers on efforts such as emissions reduction plans and product footprint, with communications selected based on carbon hotspots within the supply chain, and suppliers’ risk levels. The Carbon Action Manager also includes a Carbon Heatmap and Carbon Calculator to manage the Strategy, Risk Management, and Metrics & Targets pillars of IFRS S2.

To find out more about how EcoVadis can support your organization as it seeks to build compliance with the new rules in jurisdictions including Hong Kong, Japan and Singapore, please visit our on-demand webinar, Supporting Climate-Related Disclosures in Asia-Pacific with EcoVadis.

About the Author

Follow on Twitter Follow on Linkedin Visit Website More Content by EcoVadis EN