Let's have a look at how roughly 9,000 US companies with EcoVadis ratings measure up against our benchmarks and peers in North America and Europe.

EcoVadis recently released the eighth edition of our Business Sustainability Performance Index, exploring the data behind over 125,000 sustainability ratings delivered between 2019 and 2023.

Our ratings network has doubled since 2019, increasing its reach across global value chains. In 2023, the United States (US) led the network for the first time with nearly 5,000 ratings – a diverse data set on its own that includes companies across a wide range of industries with varying levels of sustainability management maturity and number of ratings and improvement cycles.

Part One: US Scoring Trends and Improvement

Two-thirds of US companies are now out of the high to medium risk range, scoring 45+ points. Companies outside the “Good” or “Advanced” performance ranges have taken minimal steps on sustainability management and have significant risks in their operations and value chain. About one-third of small (under 100 employees) companies and medium-sized (100-999) peers fell into “Insufficient” and “Partial performance levels in 2023. Alarmingly, this figure climbs to 48% for large companies. Accelerating improvement among this group will be critical in further de-risking the US network, as those with 1,000+ employees comprise a sizable share of companies in the country (24%).

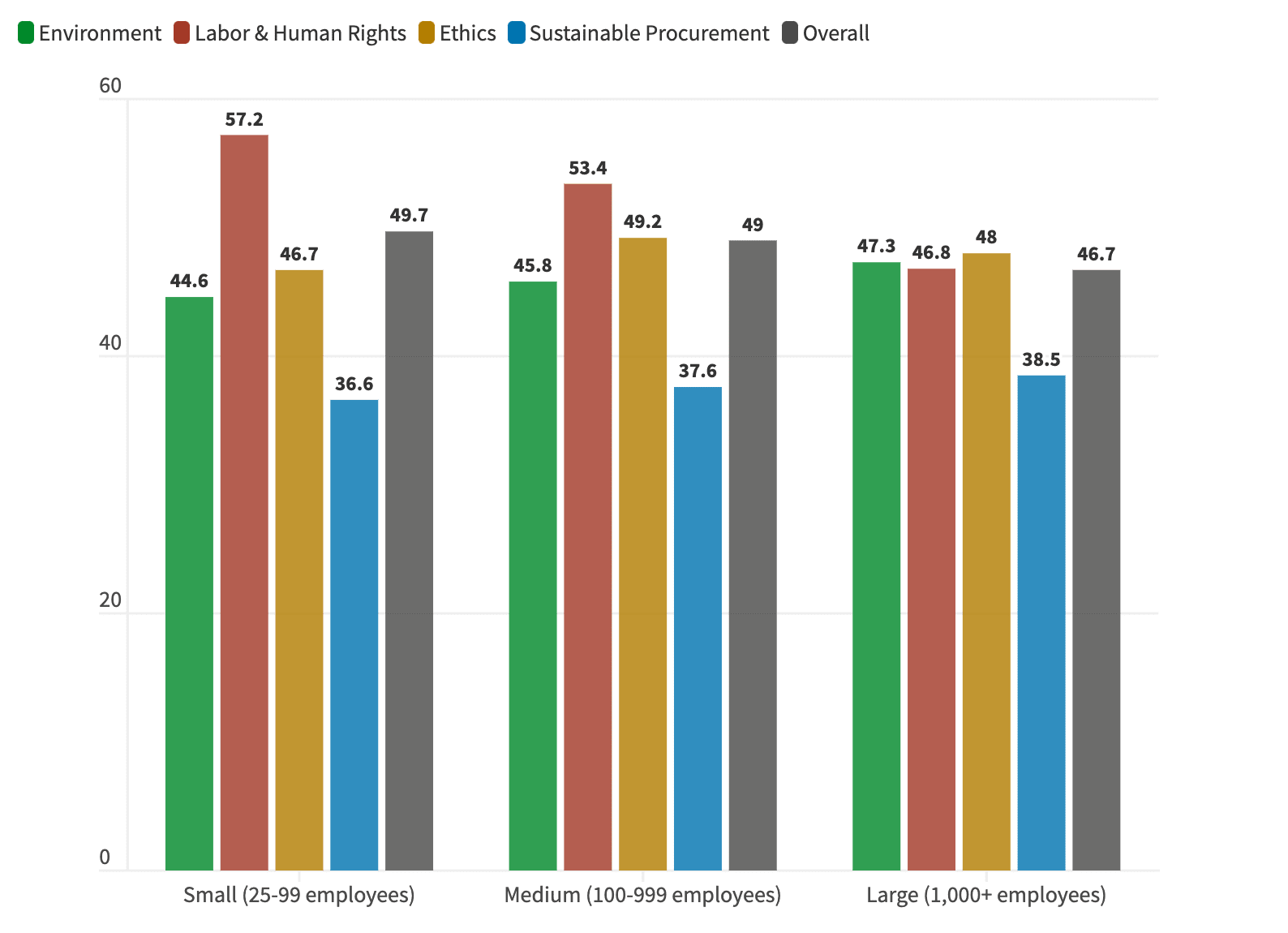

Average scoring for small, medium and large companies in the US (2023)

Performance disparity by size is most pronounced on the Labor & Human Rights theme.

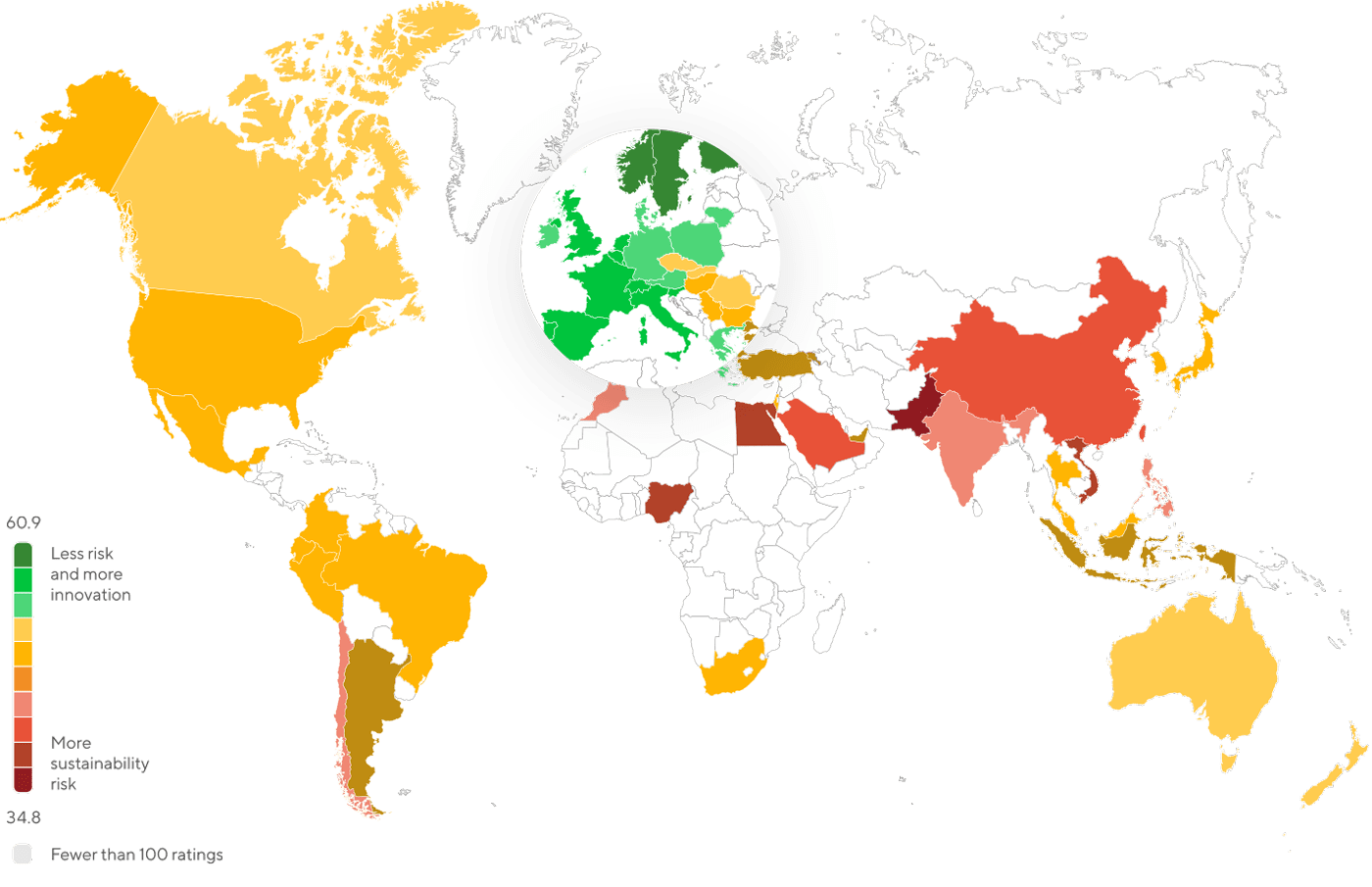

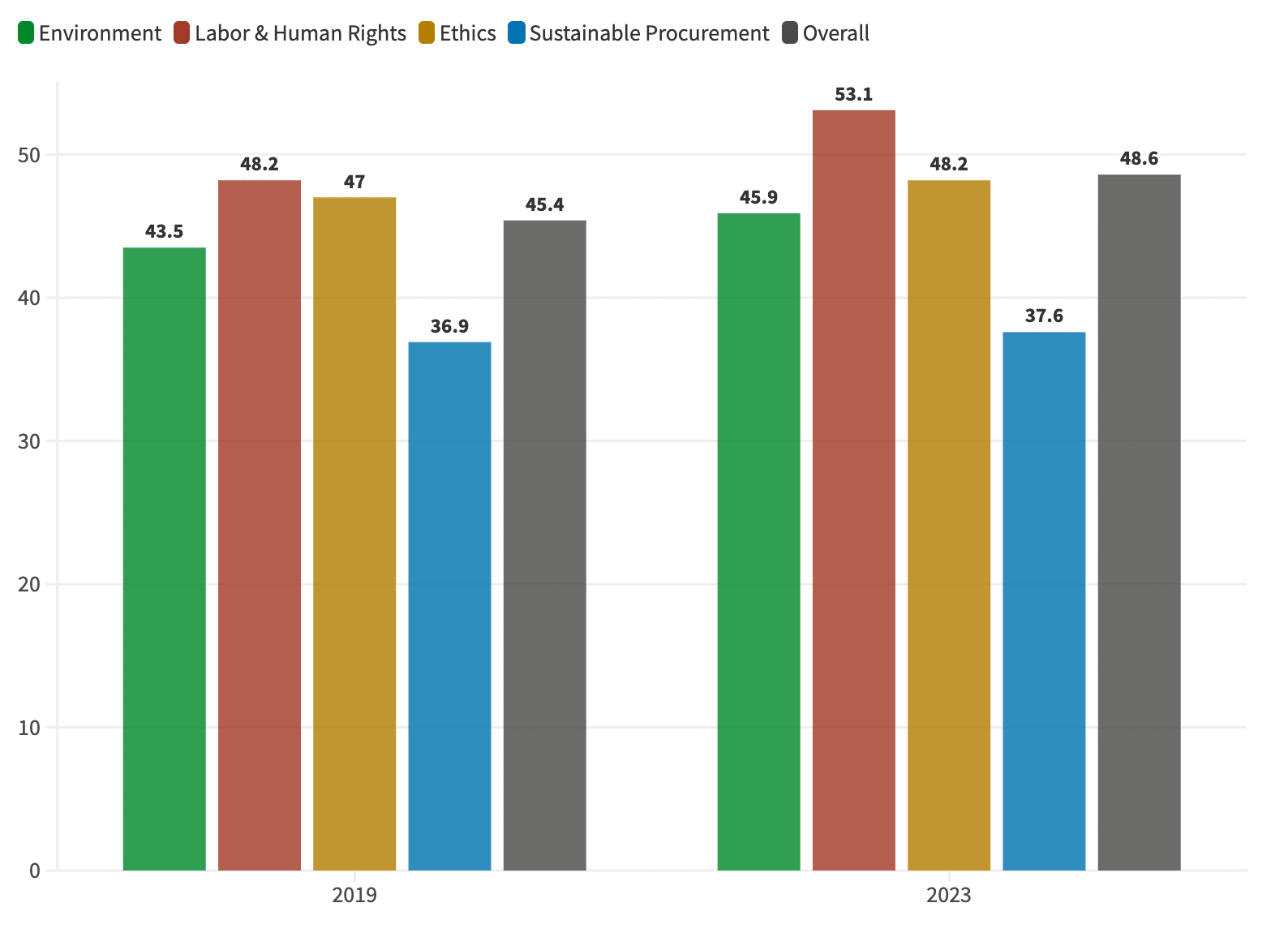

In 2023, the average score for the typical US company was 48.6, 0.8 points higher than in the year before and 3.1 more compared to 2019, placing the US 28th place globally among countries with 100+ ratings. Only two other countries in the Americas made it into the top 30, Canada (51.2) and Colombia (50.2), with European and a handful of Asia-Pacific countries dominating the rankings.

Relative sustainability performance among countries with 100+ ratings in 2023

Scoring above the 45-point threshold indicates the presence of a more structured sustainability management system and policies and actions on key challenges.

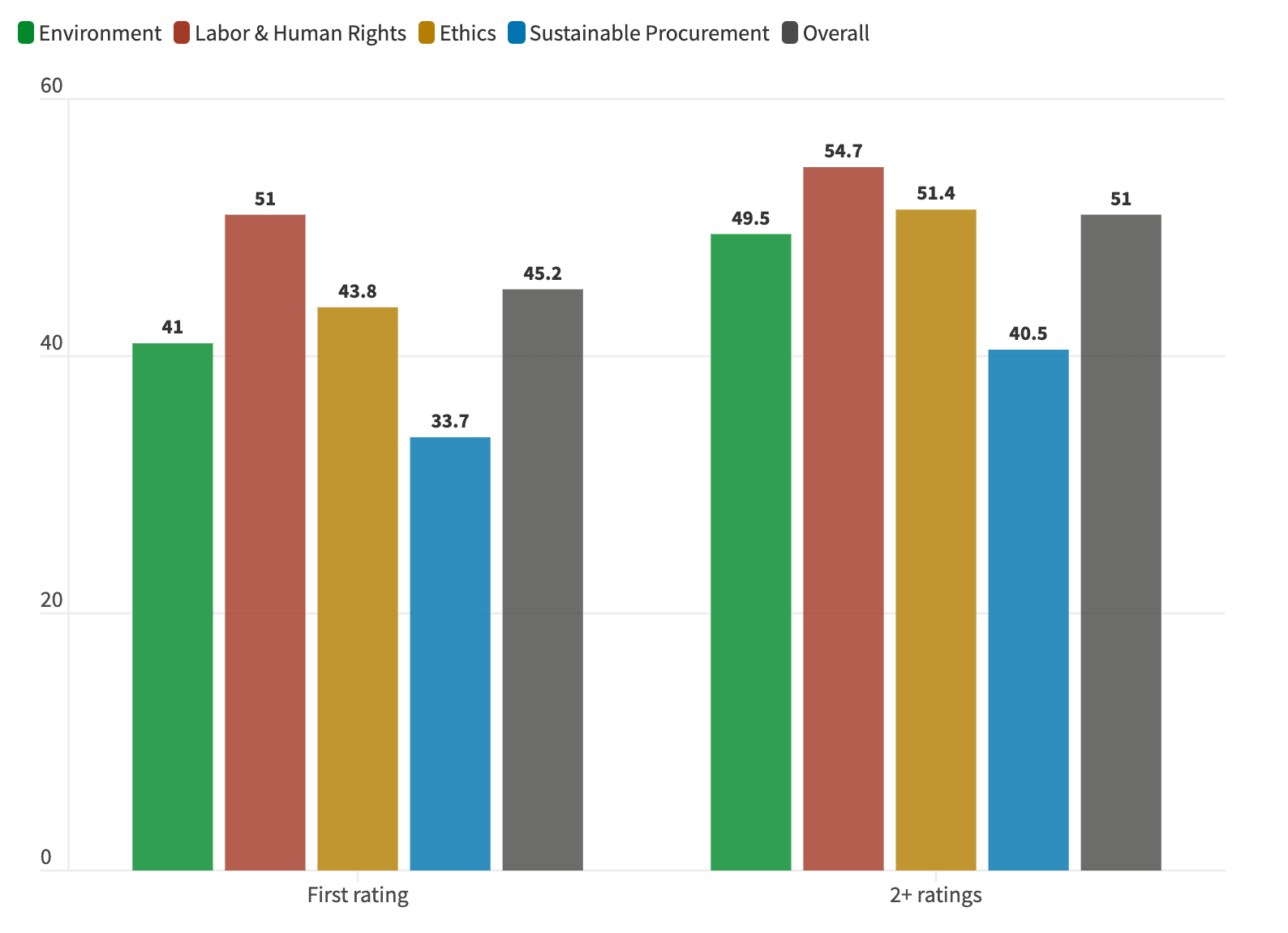

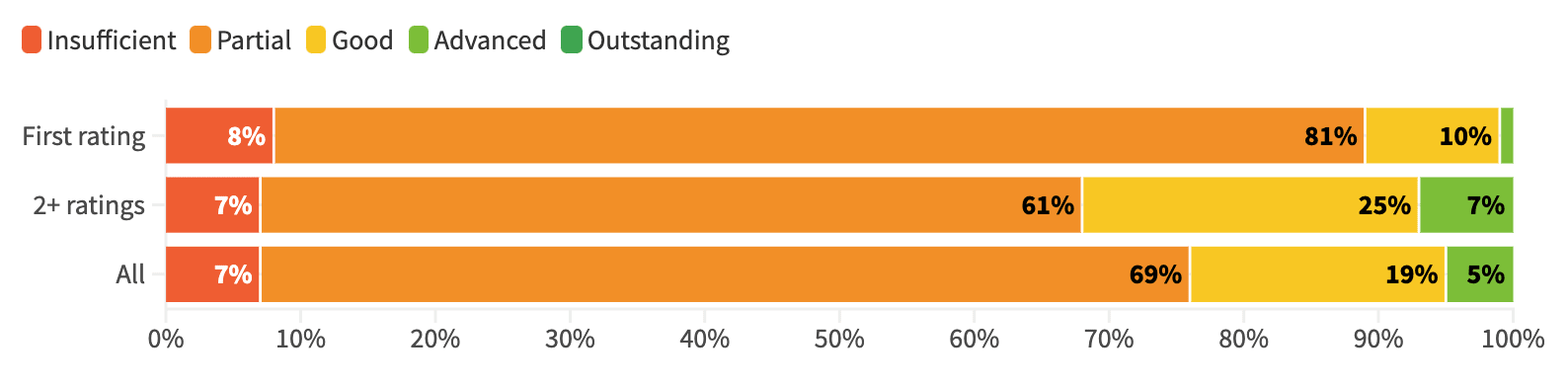

After multiple ratings, companies in the US are able to close most of the performance gap with Canada, raising their overall average to 51. The baseline for US companies entering the EcoVadis network is almost 6 points lower than the average of those assessed at least once before. Those with multiple ratings are able to raise their performance on the Environment theme more than on any other. This theme covers a range of indicators on topics including carbon, water, biodiversity, product lifecycle and more.

Performance by number of ratings in the US (2023)

Companies with multiple ratings outperform the first-rating Environment baseline by 8.5 points – more than on any other theme.

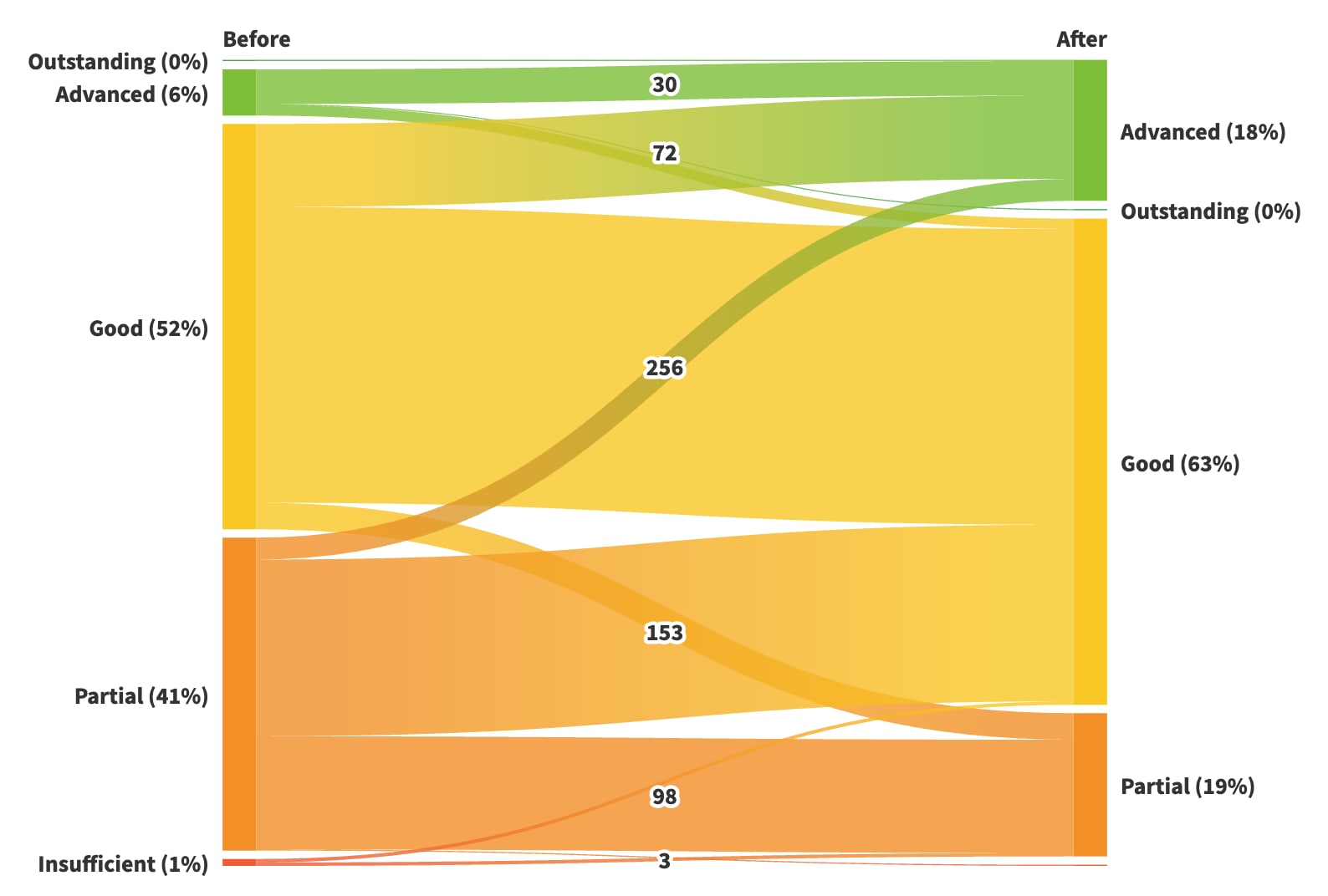

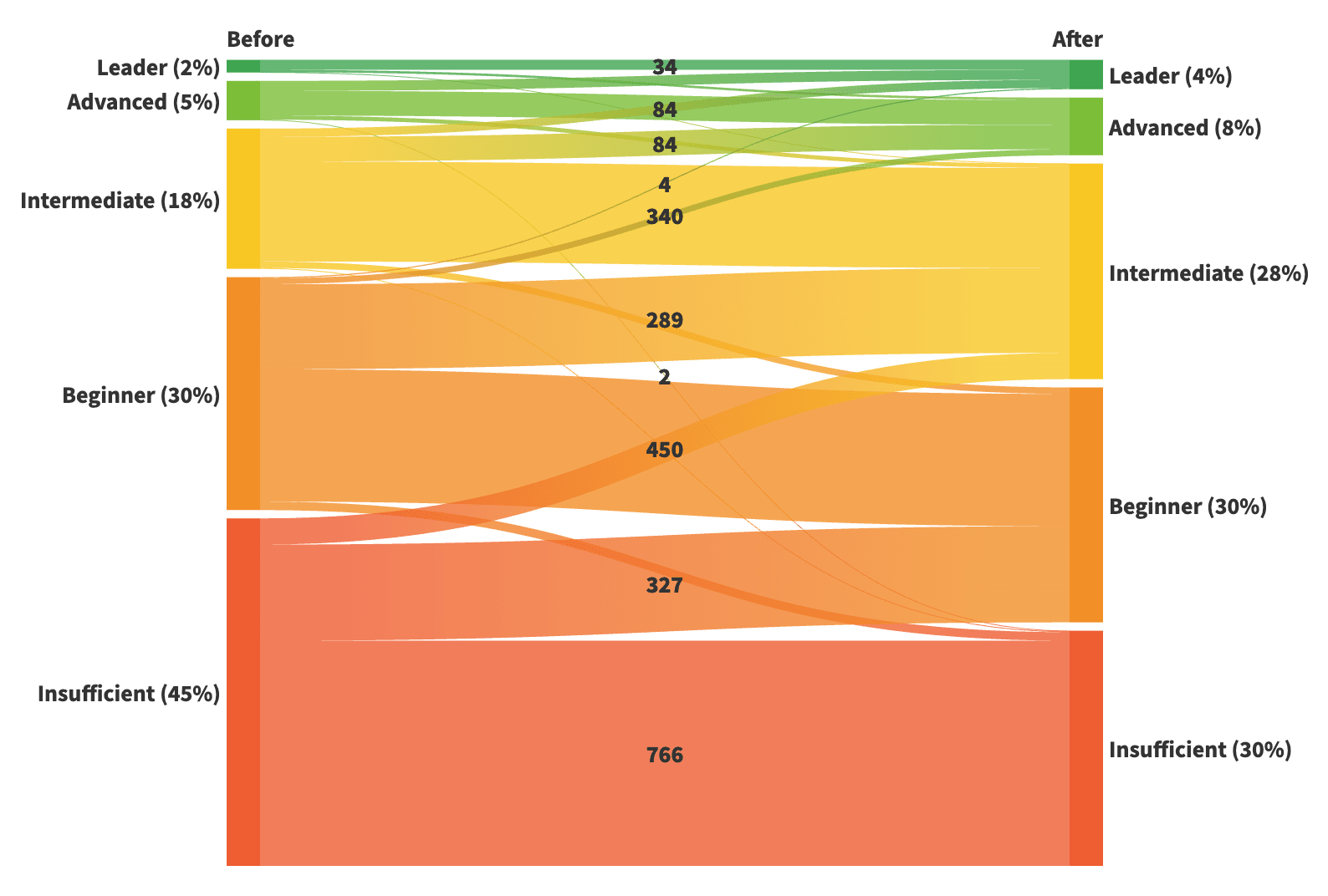

The data shows that with the right insights and tools, the typical US company can make steady sustainability progress with an additional rating cycle. Below, we highlight the improvement trajectory of companies rated in 2019 and again in 2023. Of those scoring below 45 points at first, more than a quarter (26%) moved up at least one performance level, with their improvement halving the initial number of companies within the high-medium risk range.

Progression of US companies rated in 2019 and again in 2023

Many are not yet “leaders” but have been able to progress out of the Insufficient and Partial performance categories.

Leaders remain rare despite growing commitments to address sustainability gaps and adopt better practices. Of the US companies assessed, only 7% achieved Advanced performance (65+ points) in 2023. At this level, companies have a comprehensive sustainability management system and can accelerate their efforts through innovation, collaboration with industry peers and enhanced supplier engagement.

More than three-quarters of US companies are still struggling to address social and environmental challenges throughout their value chain, this is particularly true for companies just entering the network. In comparison, this indicator drops to 53% for European companies who remain at the forefront of gaining visibility into their suppliers’ performance and collaboration efforts. North America is the only region where Sustainable Procurement scoring has stagnated over the past year.

Sustainable Procurement score distribution for first-time rated US companies versus those with multiple ratings (2023)

Among US companies, about three-quarters are clustered below the 45-point threshold. In Europe, this share drops to nearly half.

The Ethics theme average for the country also dropped in 2023. US companies lost 0.8 points within a year due to underperformance across all company sizes. In contrast, they are performing relatively well on labor and human rights challenges, matching the improvement pace with their regional counterparts and European peers (all +1.5 since 2022). Only roughly one-fifth (22%) are scoring below the 45-point risk threshold, leading to the best average across all themes (53.1 in 2023).

Average overall and theme scoring for companies in the US (2019 and 2023)

Visit Index Online to compare how averages have changed over the years and narrow down results by size, industry and region.

Part Two: Three Years of Carbon Action

As noted above, the first sustainability rating baselines show there is still much work to be done across value chains. The typical company entering the EcoVadis network has a relatively low level of maturity across our assessment themes. However, the data also shows that companies rated multiple times are making measurable progress on a broad spectrum of sustainability challenges, including decarbonization.

The latest edition of our Carbon Action Report explores similiar progress made by the 22,000 companies rated multiple times through the Carbon Action Manager since its launch in 2021. The individual changes being made by the companies are quickly aggregating regionally and across global value chains.

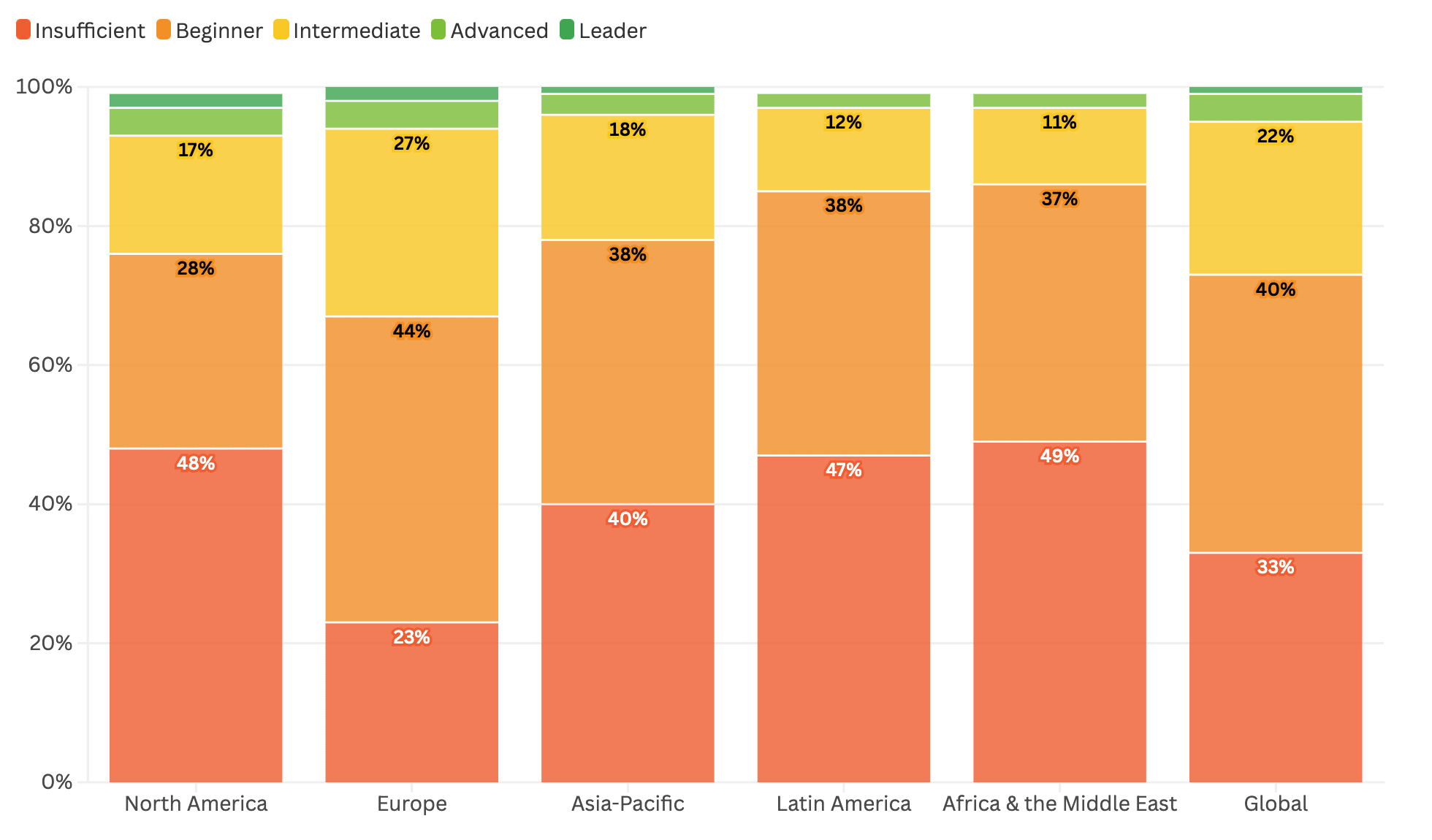

Europe leads the way, with 33% of its companies performing at an Intermediate level on carbon or above – this drops to 23% for North America. While the US and Canada have the same percentage of companies at the Advanced and Leader levels (6%) as Europe, nearly half (48%) still have Insufficient carbon management. The share of companies in the high-risk ranges emphasizes the need for more targeted improvement efforts.

Carbon maturity across regions (2023-2024)

More than 70% of companies across all regions remain at the Insufficient and Beginner levels

Although a carbon maturity gap remains between Europe and the rest of the world, companies in North America are making solid progress. Among 2,900 companies in the region with at least two carbon scorecards, one-third moved up an entire carbon maturity level, and the percentage of companies performing at an Intermediate level or above rose from 25% to 40% over the past three years. These results are largely shaped by the progress made by US companies, which make up more than 90% of the regional sample.

US companies moving up the carbon maturity ladder (2021-2024)

More than half (55%) of these companies are SMEs, which have fewer than 1,000 employees and often lack the resources and capabilities needed to start their decarbonization journey.

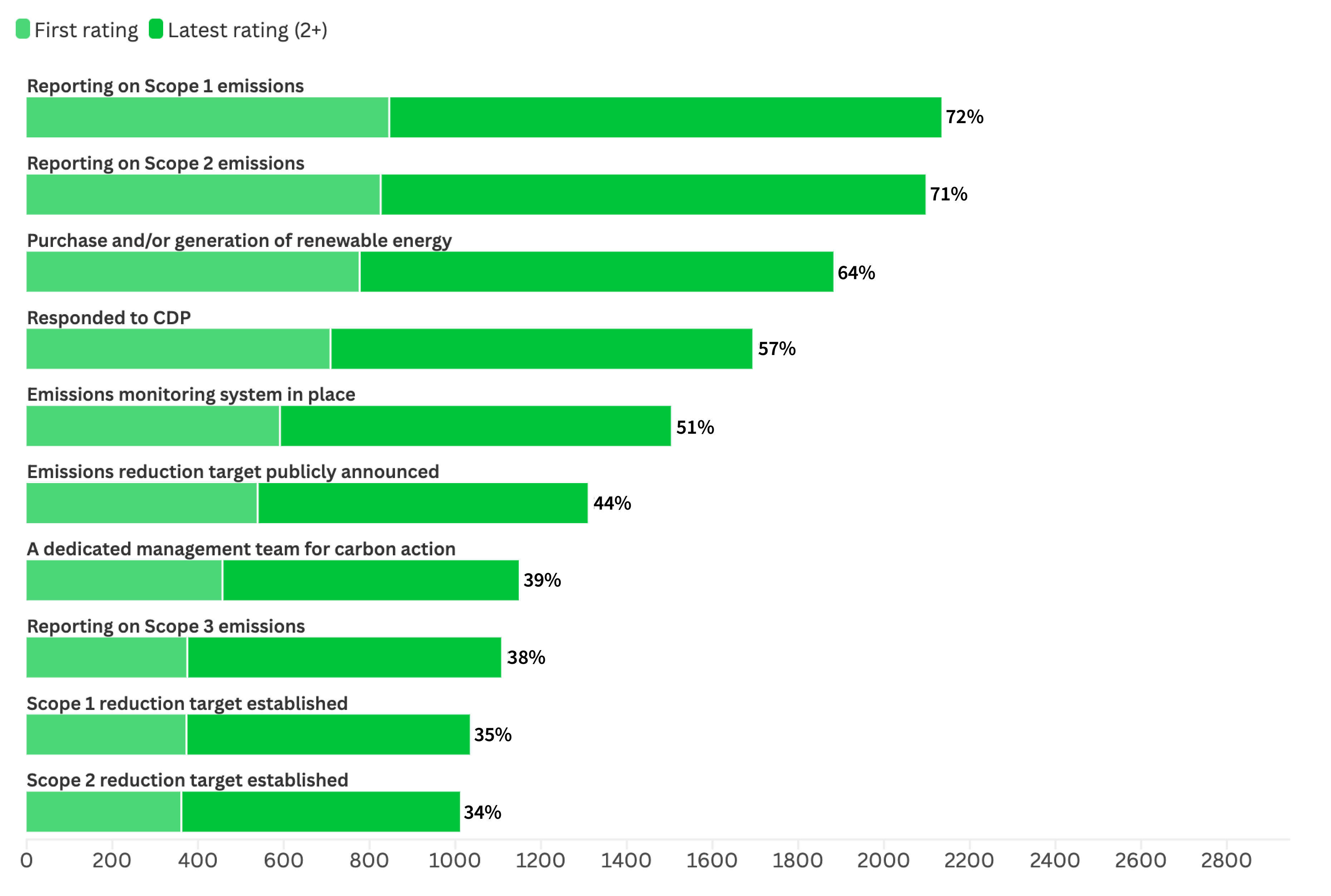

Companies in the US and Canada are also excelling on some key carbon indicators. Roughly 3,000 North American companies were assessed between July 2023 and June 2024 on a wide range of metrics. Reporting on Scope 1 and 2 emissions was the most common best practice adopted across the region. As the chart below highlights, Scope 3 reporting remains relatively low, though the impact of multiple ratings on accelerating its adoption is clear.

Progress on the most adopted practices among companies in North America: First versus latest rating

Reporting on Scope 3 emissions remains twice as challenging as reporting on Scope 1 and 2

There is no debate that decarbonization should be geared around engaging the supply base, yet many companies still need to start a supplier-led energy transition. Among North America-based companies, only 5% partner with suppliers to achieve emissions reductions and 10% select their partners based on carbon intensity. Progress on these metrics will be essential for any organization committed to value chain-wide decarbonization, long-term business viability and meeting compliance obligations emerging in the EU and elsewhere.

Ready to benchmark and improve your sustainability performance? Get started here. Want to learn more about accelerating your decarbonization journey with the Carbon Action Manager? Visit ecovadis.com/carbon or contact us for a demo.

About the Author

Follow on Twitter Follow on Linkedin Visit Website More Content by EcoVadis EN