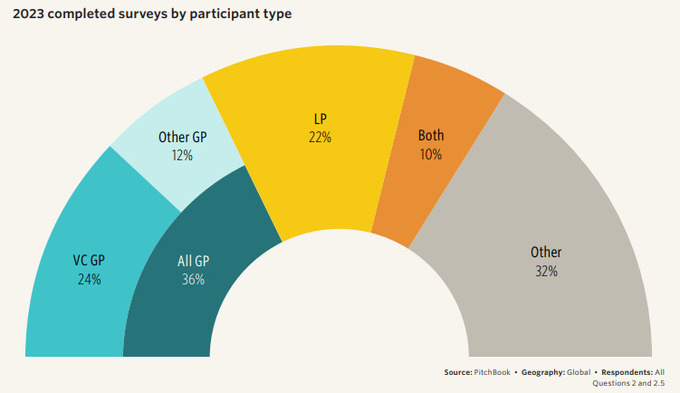

Once again, this year we asked GPs to identify whether they consider themselves to be venture capitalists (VCs), thereby allowing us to contrast how VCs were thinking about sustainable investment topics versus other respondents. 193 of our GPs identified as VCs, 109 of whom made it to the end of the survey, providing us a significant sample from which to report on VC thoughts and trends.

We also reached a broad spectrum of organizations from small to mega: 63% represented assets below $500 million, and 7% were at organizations with $25 billion or more under management or advisement. Only 5% of our GP universe were in the largest bracket, while our Other grouping was most likely to represent assets lower than $500 million, at 69%.

About the Author

Follow on Twitter Follow on Linkedin Visit Website More Content by EcoVadis EN